NIFTY 50 Market Cap at Record High

Nifty 50 market cap has hit a record high of 137,865,624 million INR on Friday, 3 Sep’21 with Nifty 50 closing at an all-time high of 17323.

Please find Nifty 50 constituents and their current market cap:

| As on Sep 3, 2021 | ||

| COMPANY NAME | MARKET PRICE | MARKET CAP ( IN INR, MILLION) |

| Adani Ports | 754.9 | 1,533,769 |

| Asian Paints | 3,338.80 | 3,202,570 |

| Axis Bank | 798 | 2,443,049 |

| Bajaj Auto | 3,757.50 | 1,087,297 |

| Bajaj Finance | 7,523.40 | 4,533,506 |

| Bajaj Finserv | 16,734.40 | 2,663,062 |

| Bharti Airtel | 658.5 | 3,592,212 |

| BPCL | 491.3 | 1,065,754 |

| Britannia | 4,124.20 | 993,389 |

| Cipla | 941.1 | 758,955 |

| Coal India | 146.4 | 901,915 |

| Divis Lab | 5,208.30 | 1,382,640 |

| Dr Reddy’s | 4,898.60 | 814,620 |

| Eicher Motor | 2,802.60 | 765,830 |

| Grasim | 1,510.50 | 993,802 |

| Hcl Tech | 1,174.80 | 3,187,878 |

| HDFC | 2,758.60 | 4,966,020 |

| HDFC Bank | 1,576.10 | 8,680,343 |

| HDFC Life Insurance | 734.4 | 1,483,823 |

| Hero Motor | 2,799.50 | 559,239 |

| Hindalco | 461.3 | 1,036,349 |

| HUL | 2,766.70 | 6,500,517 |

| ICICI Bank | 724.3 | 5,000,345 |

| Indusind Bank | 1,003.80 | 759,944 |

| Infosys | 1,700.70 | 7,244,068 |

| IOC | 113.1 | 1,064,741 |

| ITC | 210.6 | 2,591,457 |

| JSW Steel | 690.9 | 1,670,058 |

| Kotak Bank | 1,791.90 | 3,548,721 |

| L&T | 1,691.50 | 2,375,300 |

| M&M | 749.9 | 932,270 |

| Maruti | 6,863.10 | 2,073,206 |

| Nestle | 20,266.70 | 1,954,024 |

| NTPC | 117 | 1,134,510 |

| ONGC | 123.1 | 1,548,632 |

| Power Grid | 175.6 | 918,406 |

| RIL | 2,388.50 | 16,151,198 |

| SBI | 431.4 | 3,850,077 |

| SBI Life Insurance | 1,244.20 | 1,244,200 |

| Shree Cement | 30,440.80 | 1,098,327 |

| Sun Pharma | 789.4 | 1,894,035 |

| Tata Consumer | 869.9 | 801,612 |

| Tata Motors | 295.6 | 912,946 |

| Tata Steel | 1,443.70 | 1,738,338 |

| TCS | 3,842.10 | 14,416,850 |

| Tech Mahindra | 1,442.00 | 1,394,976 |

| Titan | 2,019.30 | 1,792,707 |

| Ultratech Cement | 7,929.90 | 2,288,847 |

| UPL | 752.8 | 575,173 |

| Wipro | 655.1 | 3,744,118 |

| TOTAL | 137,865,624 |

The current level of Nifty 50 is:

This is testimony to our last post on 23’rd Aug’21, wherein we gave the target of 17100-17300 for Nifty 50.

This rally was supported and backed by better than expected Indian economic numbers that came this week :

- April-June quarter GDP expands 20.1% YoY

- Nominal GDP growth at 31.7%

- GVA expands 18.8% YoY

- Construction sector growth at 68.3%

- Manufacturing sector growth at 49.6%

- Mining sector growth at 18.6%

- April-July fiscal deficit nears Rs 3.21 trillion

India’s Gross Domestic Product (GDP) for the April-June quarter (Q1) of the ongoing financial year 2021-22 expanded 20.1% YoY, as per data released on 31 Aug’21. The sharp rise in Q1 GDP data can be attributed to a low base last year. In the April-June quarter of 2020, the economy contracted 24.4% due to the Covid-19 lockdowns. The economy grew by 1.6% for Q4 of FY21.

The reflection of above was clearly visible on nifty 50 move.

The final push on Friday was given by Reliance as its closer to its all time high of 2400 with green energy speech and plans by Mr. Mukesh Ambani.

While India has picked up after covid 2’nd wave, there are still following challenges in rest of the world:

- Crackdown on tech and private sector in China by authorities

- Delta and new variants of Covid posing a challenge in developed countries like US, Euro Zone, etc.

- Global supply chain staying disrupted because of covid 19 bottlenecks.

- Growth numbers receding in US. On Friday , 3 sep’21, non farm payroll data came in at 235k, much lower than the forecast of 750k. Non-farm Payrolls measures the change in the number of people employed during the prior month, excluding workers in the farming industry. Given that full employment is one of the Federal Reserves mandates, a weaker than forecast reading is generally negative (bearish) for the USD and signals that Fed support is going to continue without taper.

With above background, India has outperformed other benchmark indices across the world and we expect it to continue for remainder of this year.

In short term, Nifty has achieved its target of 17300 and can follow a consolidation.

Now, some pullback and correction can follow which can be in the range of 5-20%.

Our stance in short term is cautious with profit booking and a micro based approach through individual stocks rather than on Index.

Please find our short term calls:

- Nifty 50- 16600-17600 range.

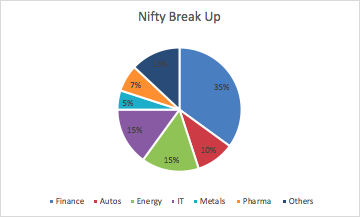

- Bullish on RIL, Tech and FMCG.

- Bullish on Banks and Insurance.

- Bearish on Auto’s because of less than expected demand and semi-conductor issue.

For more equity updates, please find our link: