ETF, Exchange traded funds and Index Funds

It’s an interesting read for everyone about these two financial instruments, which has the potential to create a huge amount of wealth, over a medium to long term. ETF, Exchange traded funds and Index Funds are almost same with few differences as highlighted below.

Index funds are mutual funds associated with a particular index like,

- Sensex

- Nifty

- Nifty IT

- Nifty Bank

- Dow jones

- Nasdaq

- International Market, etc.

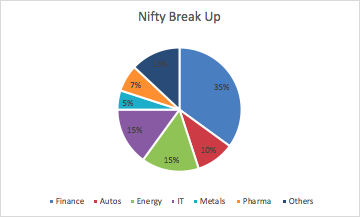

These funds buy securities in same proportion as they are in the above respective indexes, to create a mirror image of them.

This is done, so as to give a chance to an investor to take exposure in a particular theme for generating better returns, thus creating alpha.

If an investor thinks, that in coming time, NiftyBank will do better than Nifty, then they can go ahead and invest in that particular index rather than investing in entire sectors through Nifty.

Also, risk for the invested amount gets diversified as the amount goes into multiple securities of that index. This means that if one security falters in its earnings and returns, it is made up by others.

There are also several criteria’s for stocks and securities to be a part of index like:

- Certain size of a company.

- Certain minimum number of volume in trades.

- Past performance.

- Growth potential in revenue and earnings.

Only, when all the above check boxes are ticked, a company becomes a part of an index. Thus, an investor doesn’t have to do that homework at his end for carving out quality companies to invest.

This also ensure that laggards in index are taken out from time to time and are replaced with new winners.

Hence, an index over a medium to long term will always give decent returns to an investor by minimizing risk.

Few of the index funds in India are:

- HDFC Index fund, Nifty 50

- Motilal Oswal S&P 500 Index fund

- Axis Nifty 100 Index fund, etc.

If above index funds are listed on exchanges and can be traded like securities, then these are called ETF, exchange traded funds.

Few of the advantages and differentiating factors of ETF’s are:

- They are traded like securities and hence can be bought and sold like a share.

- You get the price at which you buy or sell. Where as, in the case of Index funds, NAV’s are declared at the end of the day. Hence, depending upon time of your purchase, value of investment varies. This is a differentiating factor when there are days in stock market of big movements like 4-10%.

- In ETF’s, one unit can also be bought and investments can start with a very low amount too. However, in index funds, there might be a certain criteria for a minimum amount to be invested.

- In an index fund, there can be a condition of lock in. This is not the case with ETF’s.

- In ETF, cost is slightly higher as there is STT, securities transaction tax and other government taxes involved. This is not the case with Index funds.

Few of the ETF’s are:

- Kotak Gold ETF

- Motilal Oswal Nasdaq 100 ETF

- SBI ETF Sensex

- Nippon ETF Hang Seng

Hence, it is clear from above that index funds and ETF’s are a great financial instruments, which offers an opportunity to an investor to diversify his risk and ensure decent returns.

I would again like to highlight the biggest advantage of such funds is that laggard companies are replaced from time to time and better performing ones are inducted in it. This ensures much better returns and fund value grows over time, as compared to other styles of investing in secondary markets.