Invest in Share Market

Invest in share market is a fancy and dream for virtually every investor and each one of us have taken the plunge at least once in our lives to do it.

If not, I am sure the event is not far away.

It’s exhilarating to see the sharp and volatile movements of price in both up and down direction. The returns which can be given by a stock in a day, week, month, year, multiyear forces us to compare it with parallel avenues of investment and its very common to feel pity on other alternatives which falls flat as compared to the extrapolation we end up doing in hindsight.

Well, this pity is just in theory and fades away with time.

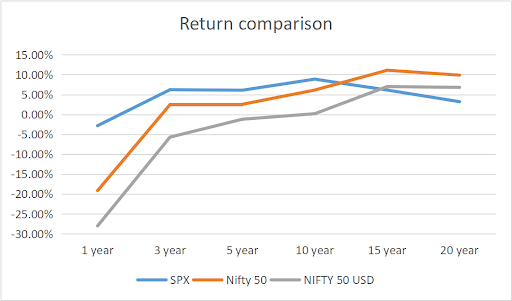

There can’t be a better day to write this blog as Nifty 50 has completed its 25 years. It was constituted in India in 1996.

It has given a return of 13 times since inception, which means a compounded return of 11% over the years.

Now, it doesn’t sound so fancy as we think share market means at least 100% compounded return for as long as we invest.

This is the biggest myth and wrong expectation from share market which has made it earn a reputation of a gamblers paradise and hub of speculative activity.

Share market, like any other market place, is a common ground for buyers and sellers to meet and enter into a transaction. As long as the fundamentals of trade are followed like valuations, time horizon, limited risk, etc., there will be no challenge in an investment call.

This is exactly what is done and followed in other alternative investment classes like:

- Bonds

- Real Estate

- Fixed Deposits

- Currency

- Precious metals like Gold and Silver

- Energy, etc.

If we follow the basics of investing in share market too, there will be no challenge.

If you want to directly start investing in stocks, then you should be clear with few basic principles and ethos of it like:

- Return on Equity

- Return on Capital

- Cash Flows

- Volume

- Valuation

- Return on investment

- Business cycle.

- PESTEL analysis

- Business Macros and Micros

- Growth prospects

- Earnings,etc.

The threat arises when we start speculating in the arena and start looking at share prices like numbers. If we bet on a number only, then the result of it will also be like an outcome of a lottery or a casino. If we get it right, exponential profit and if we get it wrong, loss of capital.

Investment in share market, as the term investment suggests should be done as per the fundamentals and principles of investing.

However, if someone wants to trade and speculate, then it should be done with that strategy, skills and mental approach.

We should not try to marry both the approaches, as that’s where the problem starts and leads to serious repercussions.

Hence, the choice has to be made by you and an apt action can be taken then.

If you want to go ahead and start investing in share market, one of the best options is to put it in Nifty 50 Index funds. Most of the professionals also find it tough to beat returns of an index in a long run. This way, you will get an exposure in share markets and you don’t have to go through the hassle and huge effort in doing research and analysis on your own.

If you want to go for trading, make sure that you pick up a course that makes you understand the basic concepts of short term approach like:

- Technical Analysis on charts

- Study of simple and exponential Moving Averages

- Bollinger band

- Macd

- RSI, etc.

With proper skill set and understanding of what an individual is doing, he will be better prepared to manage and handle risk.

Thus, conclusion is that share market offers every opportunity to an individual to experiment with his money.

What matters is that we should be clear with our motive and approach.

With that, investment in share market and trading in it will offer its own respective rewards with its own due risk.