Covid Jitters for Indian Stock Markets

It was just on Thursday, 1’st April’21, when everything was looking bullish and happy on indices and here comes the Covid jitters for Indian stock markets. Nifty was down by almost 400 points at one point. It finally closed at 14637, down by 229 points.

Last week, out of three days of trading, Nifty closed above 14850 on two occasions, which is a key resistance level and after the announcement of:

- US Infrastructure package of $2 trillion last week.

- Much better than expected employment data on Thursday where in the US economy added close to 9 lakh jobs against the expectation of 6 lakhs.

The expectations were of a higher opening.

I understand that these are US announcements and the usual thought is that how come we will be affected by it.

Well, looking at last 3 decades, barring companies which perform exceptionally well and their growth reflects in their share price, we are influenced by global factors in short term.

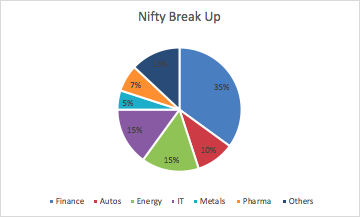

Please find the sector wise break up of Nifty:

| Finance | 35% |

| Autos | 10% |

| Energy | 15% |

| IT | 15% |

| Metals | 5% |

| Pharma | 7% |

| Others | 13% |

It is evident from above that sectors like Pharma, IT, Metals which are much more closely related to US and global economy, drives and control a significant portion of nifty earnings and valuations.

Also, the role of FIIs and foreign money plays a major part in driving our stock markets and we can’t be insulated from mother market, which is US.

Over the weekend, India became a no 1 country in terms of daily Covid cases with 1 lakh count and thus it was followed by very strict lockdown guidelines in Maharashtra and Rajasthan. This spoofed the markets and the fear drove them lower.

With earnings that will start coming in from next week and optimistic US economy scenario, we are cautiously positioned on the markets.

As we have highlighted before, please watch out for earnings and from technical stand, keep an eye on sectors and stocks which are correcting less than the market, as they are the ones which will drive the next leg up.

Our bias is also towards PSU basket with latest announcements by Indian government in budget’21 and certain stocks can be looked at like PSU banks, Gail, BPCL, etc.

At an index level, keep an eye on the range of 14250-15000 for Nifty.